|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

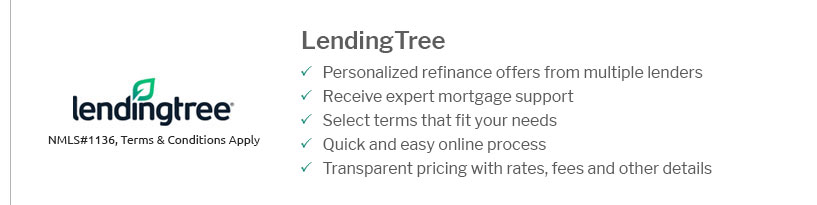

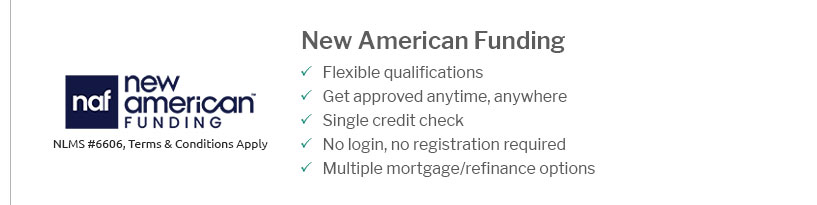

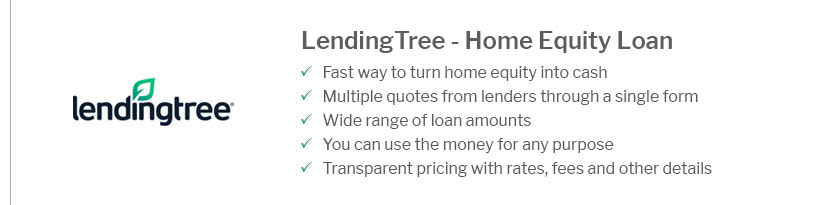

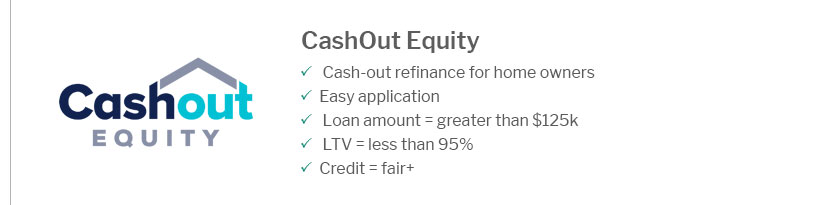

How to Lower Refinance Closing Costs for Your Home LoanRefinancing your mortgage can save you money in the long run, but the upfront closing costs can be a barrier. Fortunately, there are strategies to reduce these costs. This article explores effective methods to help you save money when refinancing your home loan. Understanding Refinance Closing CostsBefore diving into ways to lower costs, it's crucial to understand what refinance closing costs entail. These are fees you pay when you close on a new mortgage, covering various services and processes. Strategies to Lower Your Costs1. Shop Around for LendersOne of the most effective ways to lower refinance closing costs is to shop around for the best place to refinance your house. Different lenders offer different rates and fees, so it's wise to compare multiple offers.

2. Opt for a No-Closing-Cost RefinanceA no-closing-cost refinance rolls the closing costs into the loan balance or exchanges them for a slightly higher interest rate. This can be beneficial if you plan to move or refinance again soon. 3. Evaluate Your Loan EstimateCarefully review your Loan Estimate, a document provided by your lender, to understand each fee. You may find unnecessary or inflated charges that you can dispute or negotiate. 4. Utilize Lender CreditsLender credits can help offset some of your closing costs. While this may increase your interest rate slightly, it reduces the upfront financial burden. Additional Tips

FAQWhat are typical refinance closing costs?Refinance closing costs typically range from 2% to 5% of the loan amount. These costs include application fees, appraisal fees, and title insurance. Can I roll closing costs into the loan?Yes, you can roll closing costs into your loan, but this will increase your loan balance and potentially your monthly payment. Is it worth paying closing costs to refinance?It depends on your financial situation and how long you plan to stay in the home. If the long-term savings outweigh the costs, it could be beneficial. https://www.nerdwallet.com/article/mortgages/strategies-to-keep-your-closing-costs-low

You can reduce closing costs by shopping for the lowest lender fees, asking the seller to contribute and closing near the end of the month. https://jetdirectmortgage.com/how-can-i-avoid-closing-costs-on-a-refinance/

Strategies to Reduce or Avoid Refinancing Closing Costs ... Lenders are sometimes willing to negotiate on closing costs to secure your business. https://themortgagereports.com/22295/how-to-negotiate-refinancing-costs

Ask for waivers, discounts and rebates. Knowing which closing cost fees are negotiable on a refinance loan will help you save money and get the ...

|

|---|